How the Ethereum Ecosystem is Powering Real-World Adoption

It’s 2025, and institutional interest in public blockchains like Ethereum is no longer a novelty, it’s the norm. But beyond the headlines, real signs of adoption are showing up onchain.

Ethereum has evolved from an experimental network into the backbone of a thriving, global ecosystem powering real-world adoption. From DeFi to consumer apps, it’s driving real impact beyond speculation.

This article explores how that adoption is unfolding onchain. We highlight key trends like rising asset flows and growing activity on Layer 2s, and examine how developers are working to support and scale with this momentum to turn Ethereum into a reliable foundation for everyday digital infrastructure.

1) Scaling in Action: Base Leads Ethereum’s Transaction Activity

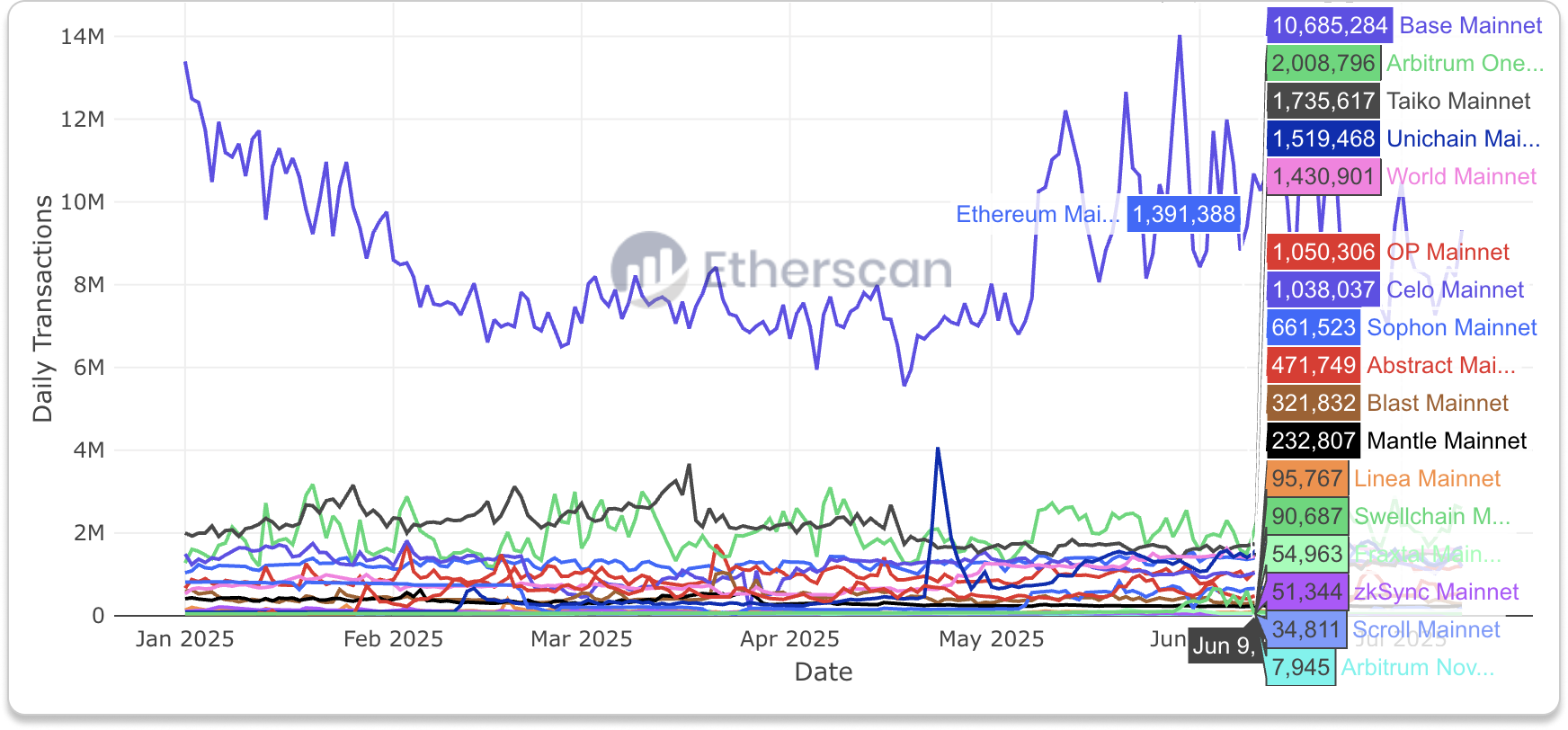

Since the start of 2025, Ethereum ecosystem chains tracked by Etherscan have processed nearly 4 billion transactions, a powerful signal of onchain activity scaling up. Base led the surge with 1.66 billion transactions (43.6%), outpacing Taiko at 388 million (10.2%) and Arbitrum One at 382 million (10%).

As Ethereum’s most active Layer 2, Base offers a snapshot of how scaling infrastructure is enabling broader participation. Transaction volume on Base grew 52% from 1.04 billion since H2 2024, fueled in part by steadily scaling gas limit since last September that allowed more transactions per block while keeping fees low for end users.

Base has also prioritized ecosystem growth by supporting DeFi, social apps, and stablecoin activity. In early 2025, several breakout apps drove 10x traffic spikes. During the Solace launch on Virtuals, Base handled 1,500+ TPS with median fees under $0.05. In response, the team increased gas elasticity to 3x, ensuring smoother UX during peak loads.

Adoption metrics tell the same story. Since January:

- 338M new addresses were created

- 34M were active in the past 30 days

- 51M account abstraction (AA) transactions

- 11M EIP-7702 authorizations - over 1,600% higher than Ethereum Mainnet

Base is also experimenting novel use cases. It’s testing AI agents for everyday tasks, launching onchain social initiatives like “Base is for Everyone,” integrating DEXs into the Coinbase app, and building a stablecoin payments stack aimed at real-world commerce. Together, these efforts make Base a key driver in Ethereum’s path to mass adoption.

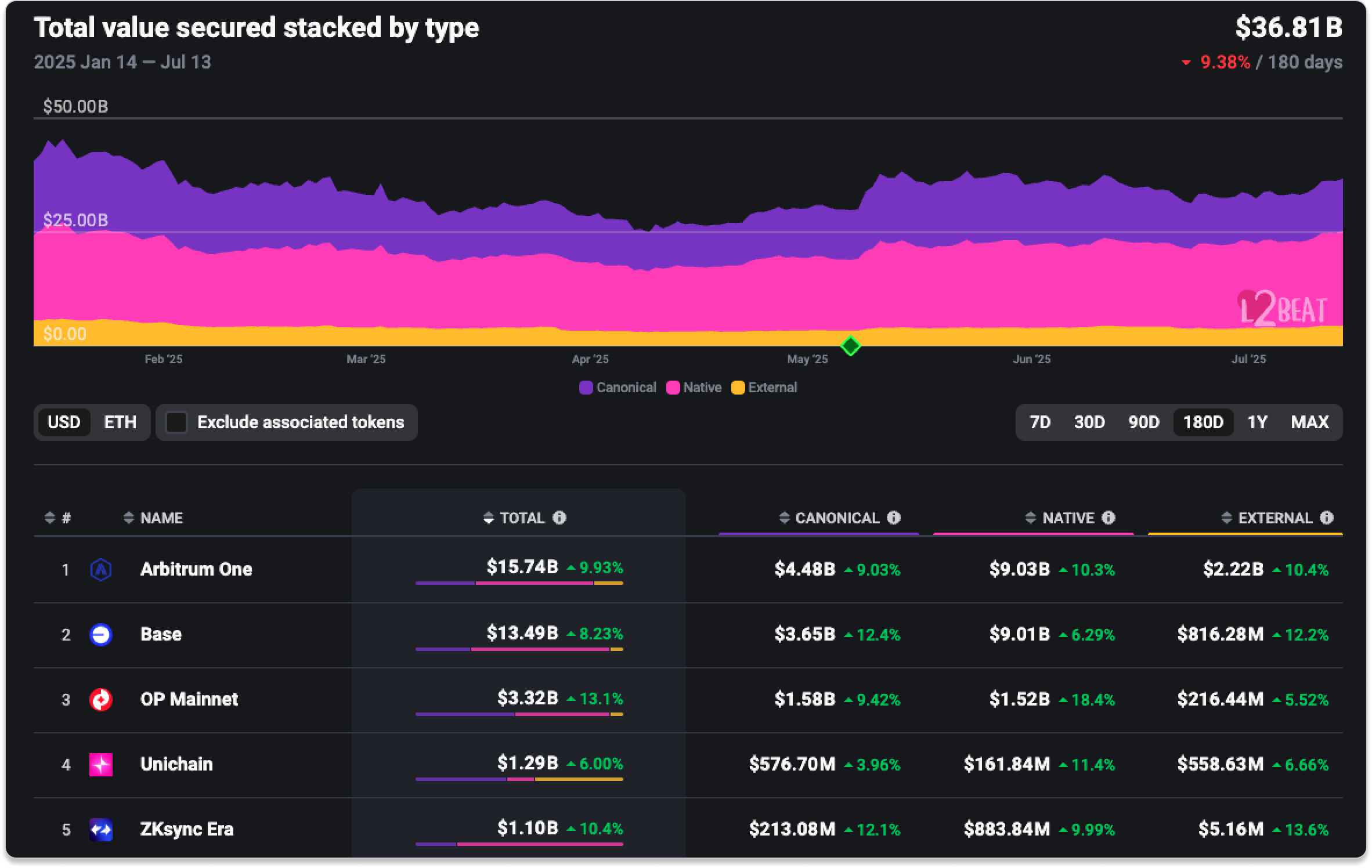

2) Value Expands to L2s: Arbitrum Leads the Way

Where users choose to hold assets and move stablecoins says a lot about trust and usability in the system. When that activity expands to faster, lower-cost chains that inherit Ethereum’s security, it shows that Ethereum scaling isn’t just theoretical, it’s working.

Arbitrum One, the leading Layer 2 by total value secured, offers a window into this value expansion. It currently secures $15.74 billion, ahead of Base and OP Mainnet, emerging as a preferred environment for transferring and settling value onchain.

Built with DeFi in mind, Arbitrum’s focus paid off:

- First L2 to surpass $300B in Uniswap trading volume

- Over $500B in total DEX swaps

- Hosts the largest Aave TVL outside Ethereum Mainnet

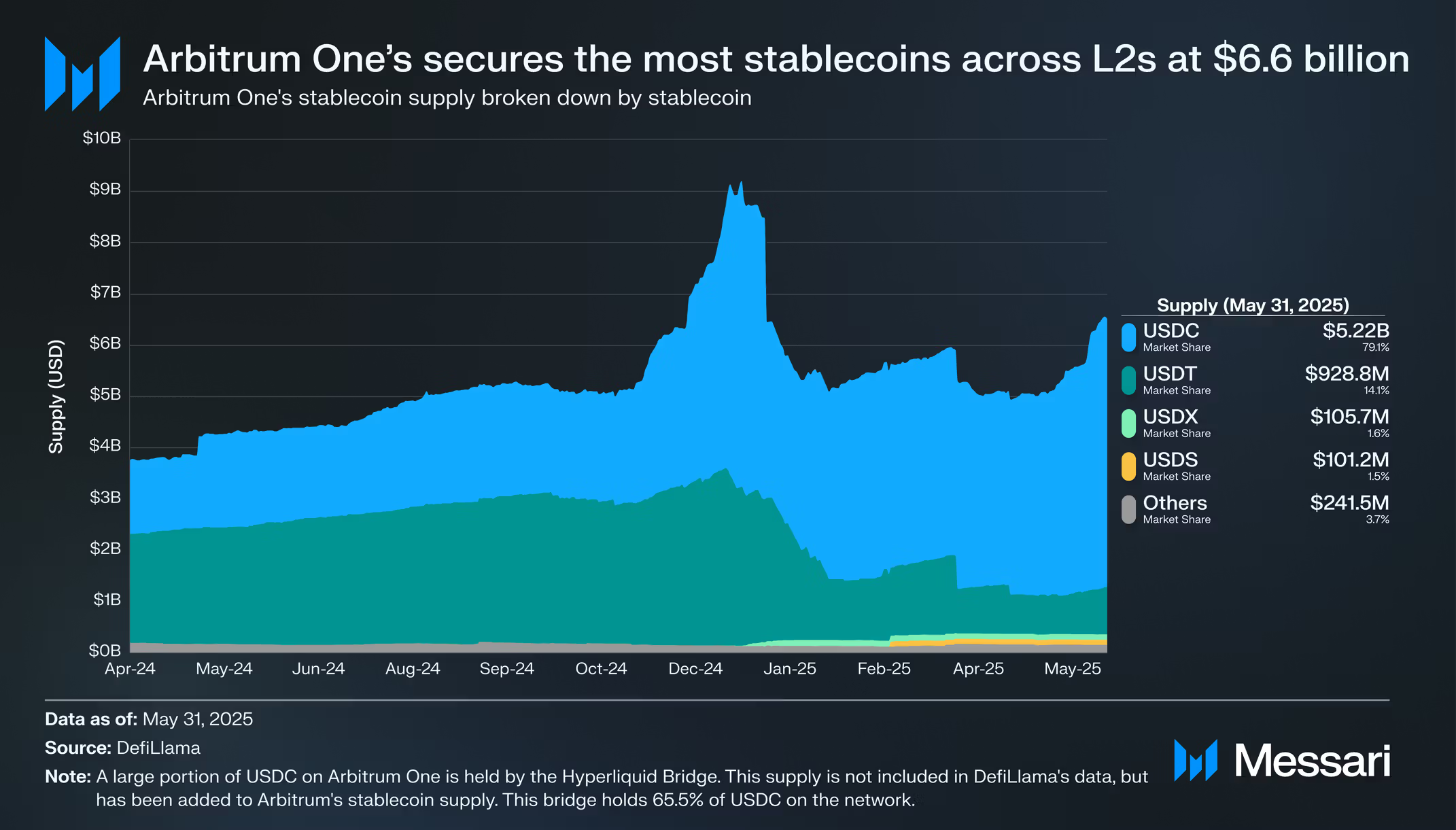

Since launch, Arbitrum has processed more than 2 billion ERC-20 token transfers, including 600+ million stablecoin transfers. Its top six stablecoins hold a combined onchain market cap of $7.16B, making Arbitrum the top L2 by stablecoin value secured, according to Messari.

But value isn’t just limited to DeFi.

Arbitrum is also growing in real-world asset (RWA) tokenization, with tokenized value rising 18% in 30 days, now totaling $292 million. While Ethereum Mainnet ($7.7B) and ZKsync Era L2 ($2.3B) still lead in RWA, Arbitrum’s rapid growth signals rising confidence in its network.

At EthCC 2025, Robinhood announced the launch of tokenized private stock derivatives (e.g., OpenAI and SpaceX) on Arbitrum One, alongside plans for its own L2 built using Arbitrum’s Orbit stack. A key reason: Stylus, a developer tool that lets teams write Ethereum smart contracts in familiar languages like Rust, C, and C++. This opens the door for traditional developers to build in Web3 with minimal friction.

From stablecoins to RWAs, Arbitrum is proving that Ethereum’s scaling efforts can support serious value and serious applications.

3) Strengthening the Foundation: Scaling Layer 1

While Layer 2s are driving growth in user activity and value transfer, their success depends on one thing: a scalable and resilient Layer 1. That’s why Ethereum’s core developers are returning focus to upgrading the base layer.

In February 2025, Ethereum raised its gas limit to 36 million, the first increase in over three years, boosting L1 throughput and enabling more onchain activity. A second raise to 45 million is currently underway, pending support from over 50% of validators.

Vitalik explained that scaling Layer 1 is important not just for raw capacity, but for supporting essential infrastructure used by L2s. Higher gas limit powers cheaper:

- Cross-L2 asset transfers

- Mass exits from L2s

- ERC-20 token issuance

- Submission of L2 proofs

Reasons to have higher L1 gas limits even in an L2-heavy Ethereumhttps://t.co/BMFhzoO8bE

— vitalik.eth (@VitalikButerin) February 14, 2025

This renewed emphasis reflects the Ethereum Foundation’s broader goal: ensure that Layer 1 can support DeFi, governance, asset issuance, and L2 settlement, all without compromising security or decentralization. A stronger L1 also lays the groundwork for shared sequencers, which improve synchronous composability and raise the total value secured (TVS) across the ecosystem.

Some of that scaling is already happening. All execution clients now support partial history expiry, allowing nodes to prune old pre-Merge data. This reduces disk usage by 300–500 GB, lowers infrastructure costs, speeding up sync times, and trimming protocol complexity.

At the same time, the Ethereum Foundation outlines plans to transition the EVM into a zkEVM within a year. This shift would let validators verify zk-proofs instead of re-executing every transaction in a block, unlocking the potential for much higher gas limits.

Yesterday, the Ethereum Foundation (EF) published a blog announcing intent to go all-in on integrating zero-knowledge (zk) into the Ethereum L1: https://t.co/HfhaMZruhV

— Raye Hadi (@rhadiARK) July 11, 2025

This could be a major upgrade, with massive implications for scalability and privacy. 🧵:

Meanwhile, Ethereum’s next upgrades will further enhance L1 scalability:

- Fusaka (next up) will introduce Peer Data Availability Sampling (PeerDAS), laying the groundwork to scale data throughput to several MB/s in future upgrades

- Glamsterdam (following upgrade) to include:

- Enshrined Proposer-Builder Separation (ePBS): Enables much larger execution payloads on L1

- Reduced Slot Times (12s → 6s): Enables faster transaction confirmations, improves DeFi efficiency, and rollup/bridge interoperability

- Fork-Choice Inclusion Lists (FOCIL): Improves censorship resistance at the protocol level

- Delayed Execution: Improves transaction ordering efficiency, reduces MEV-driven congestion, and enables more predictable block space utilization

With these changes, Ethereum Layer 1 is being optimized to serve not just today’s needs, but tomorrow’s rollups, applications, and users.

Concluding Thoughts

Real-world adoption isn’t a destination, it’s a shift in how people and institutions interact with blockchains. And across the Ethereum ecosystem in 2025, that shift is obvious: user activity is growing, value is flowing across chains with confidence, and Layer 1 is evolving to meet the demands of a more connected, high-throughput ecosystem.

Scaling today means more than throughput, it means delivering a network that’s usable, reliable, and ready for the next wave of apps and users. As Layer 2s like Base and Arbitrum lead on traction, Ethereum’s core protocol is quietly becoming the backbone that supports it all.