Exploring the Possibilities of Decentralized Finance

DeFi is a buzzword advertised everywhere in the Web3 ecosystem. A pun on the word "defy", it stands for "Decentralized Finance". But what does that actually mean?

Definition of Decentralized Finance

Decentralized finance can be described as financial products that utilize blockchain technology, replicating and, in some cases, superseding products offered by traditional finance (TradFi). It allows you to have more transparency, speed, and authority over your money compared to a centralized financial system.

With centralized banking, you can only keep track of your transactions if you are logged in to your banking account. The transactions are done by the bank. Depending on the transaction, it can take hours, if not days, for it to complete, especially for global transactions where several parties are involved.

Decentralized finance allows you to conduct any type of transaction whenever and wherever you have an internet connection. It has many of the features you see in TradFi—thanks to the versatility of smart contracts.

How Does It Work?

Starting with Bitcoin, blockchain technology allowed for basic fund transfer transactions. The transactions are recorded on the blockchain and secured by a consensus mechanism. With Ethereum, or smart contracts specifically, a decentralized application can do more than just basic transfers. Smart contracts can be programmed to work as a gateway that holds and sends funds, which means no human third party needs to be involved.

Any logic can be programmed into the smart contract, allowing for things like scheduling payments, lending, investing, trading, and more.

What Can You Do With DeFi?

Without a doubt, there are tons of things that you can do with DeFi. Here are several examples:

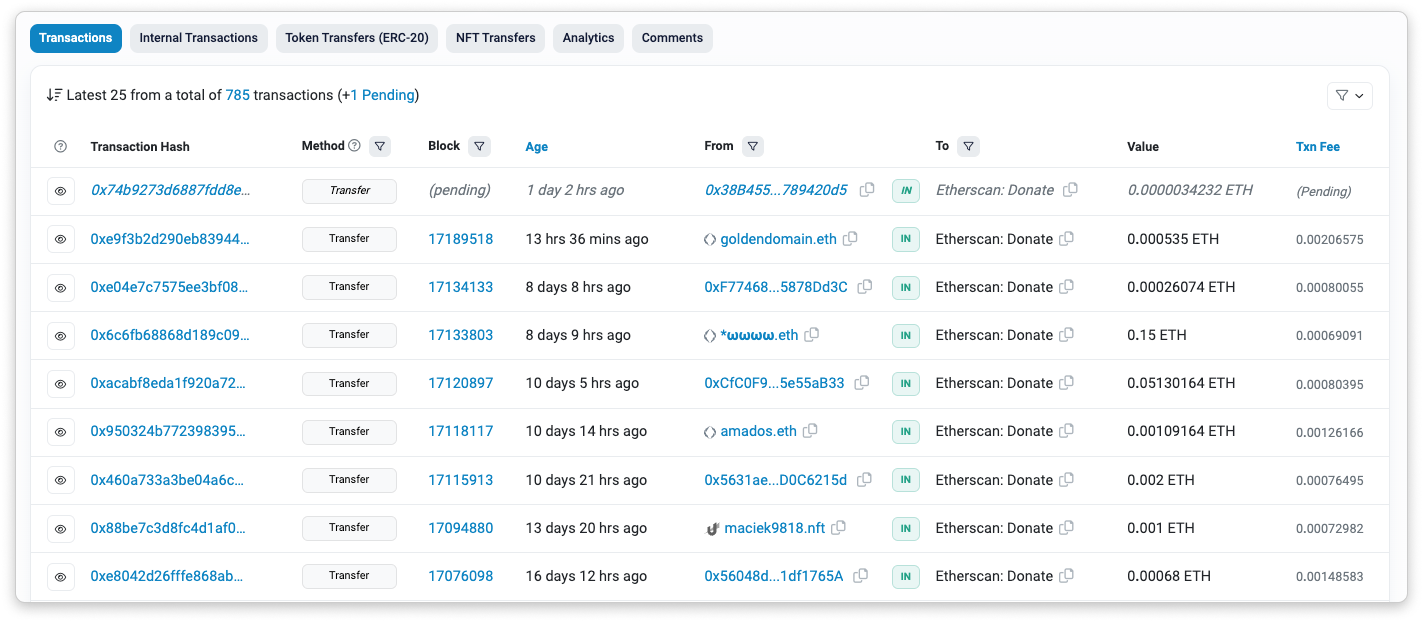

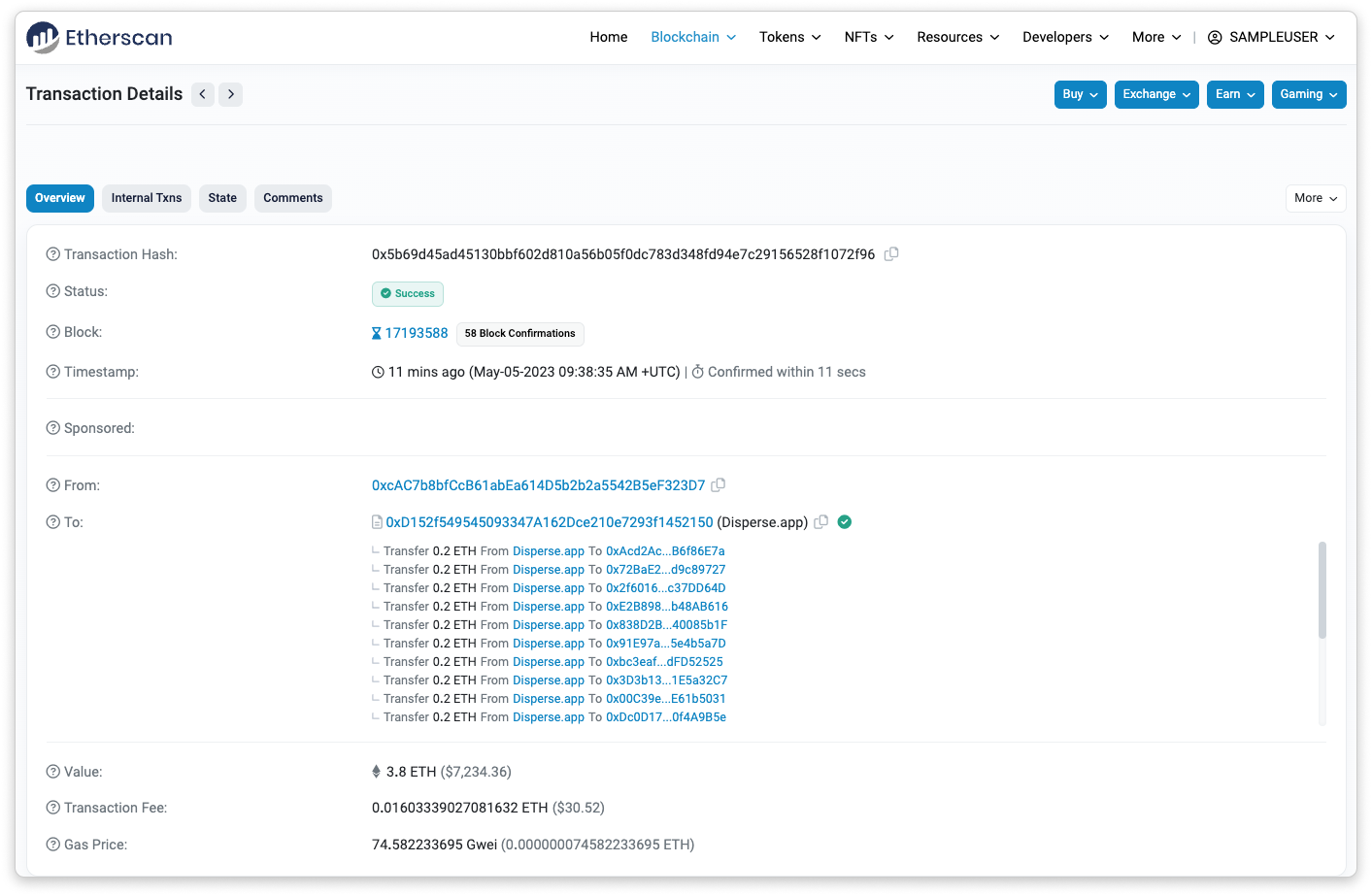

1) Sending and receiving funds

Sending and receiving funds has always been the main function of blockchains since the creation of Bitcoin. Unlike Bitcoin, smart contract-capable blockchains such as Ethereum or those running the Ethereum Virtual Machine (EVM) can do more flexible transfers. Smart contracts further enhance decentralized fund transfers by allowing for actions like bulk sending, scheduled transfers or having the transfer triggered by another on-chain transaction.

An important consideration when making EVM transfers is to make sure that the address and the network used for the transaction are correct. An error here could result in permanent loss of funds. If funds are sent to the wrong address or network, they may be unrecoverable, unless you personally know the owner of the wrong address and the funds are sent to a non-custodial wallet.

2) Bridge

Blockchain bridges permit users to swap different cryptocurrencies without intermediary with the help of smart contracts. The bridges allow tokens to be securely transferred from one chain to another. Each transfer requires a gas fee that depends on the cryptocurrency used in the swap.

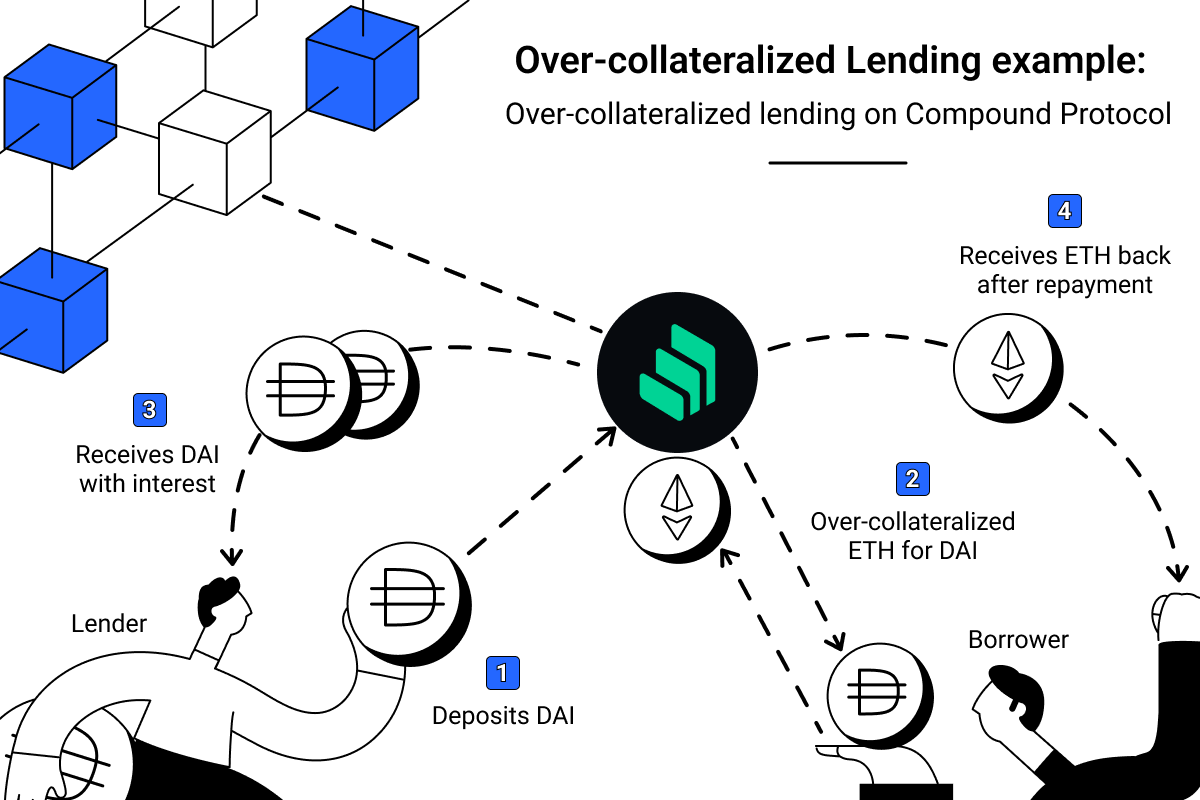

3) Over-collateralized lending

Borrowing and lending may require complicated processes in TradFi, but it is straightforward in DeFi. A majority of loans in DeFi are collateralized. Collateralized loans do not require physical assets for borrowers to take out loans. However, borrowers need to over-collateralize their loans with other cryptocurrencies.

For example, if you are borrowing a thousand DAI, you may face a minimum 150% collateralization ratio. This means you need to have $1,500 worth of a cryptocurrency locked up as collateral. As crypto is highly volatile, the currency’s price can drop at any time. If it falls below the borrowing amount, your collateral will be liquidated to cover the loan. You could increase the collateralization ratio, which means over-collateralizing more crypto, but this only increases your buffer against getting liquidated and is never a guarantee.

4) Under-collateralized lending

In comparison to over-collateralized loans, under-collateralized loans are much more accessible to most users since less funds are required to partake. There are several types of under-collateralized loans, and two of them are third-party risk assessment and crypto-native credit scores.

Third-party risk assessment requires third-party involvement, as a credit assessment. Anyone can be the credit assessor by staking funds – the amount determined by the platform – and these funds will be slashed in the event that the borrower defaults on the loan. However, if the loan is successfully paid off, the credit assessor will receive a reward for their actions.

In contrast, crypto-native credit scores are similar to how credit scores work when applying for traditional loans. By looking at a borrower's transaction history on the blockchain, the lender platform can profile the borrower’s repayment ability based on the wallet address used. However, since the transaction activity is per wallet basis, the borrower can create multiple wallets for different borrowing. To counter this issue, the platforms may require users to provide real-life information, which is not in line with the goal of decentralization.

5) Flash Loans

Flash Loans are not loans as we commonly understand them. It takes advantage of atomicity - the ability for multiple actions to be done within the same transaction - to borrow from one place, profit from another, and repay the borrowed amount all within the same transaction.In this way, you are able to ‘borrow’ without providing collateral or any personal information. However, Flash Loans may be suitable for only a subset of traders, as utilizing it requires some technical knowledge. More on Flash Loan here.

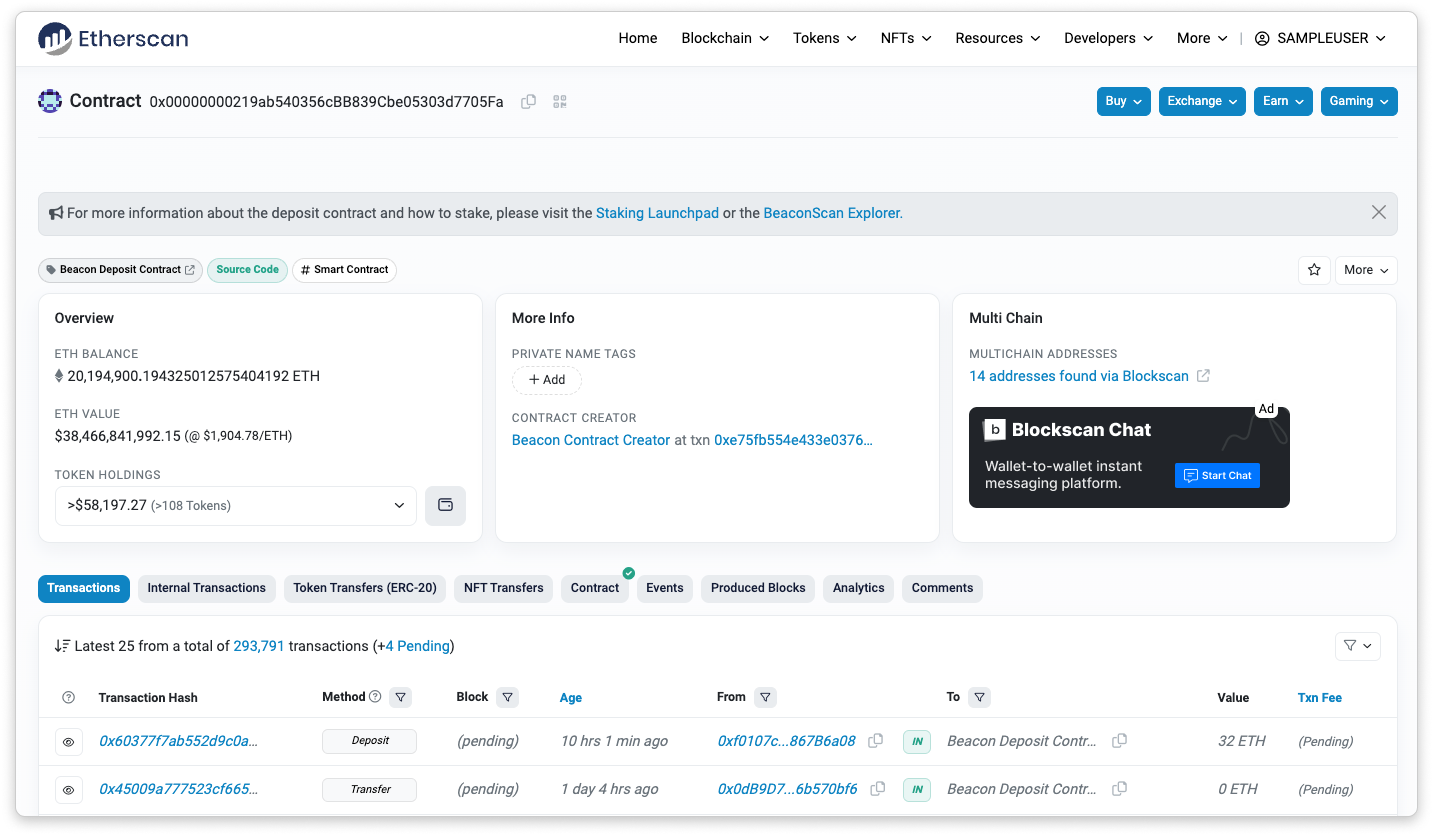

6) Staking

Staking is a term used when you lock your crypto assets into a smart contract for a certain period of time to receive rewards. There are at least three kinds of staking:

- To become a validator in a Proof-of-Stake (POS) mechanism of a certain blockchain network (such as Ethereum or Avalanche)

- To delegate or vote on a token/protocol’s governance (such as ENS or Gitcoin)

- To simply deposit tokens into a smart contract in exchange for a yield.

7) Stablecoins

Due to the volatility in crypto, stablecoins were created to provide stability, similar to how fiat works in TradFi. They are pegged to the price of a separate stable asset, most commonly with the US Dollar Stablecoins and are backed by one of these four collateral structures: crypto-backed, fiat-backed, commodity-backed, or algorithmic. Read more on Stablecoin here.

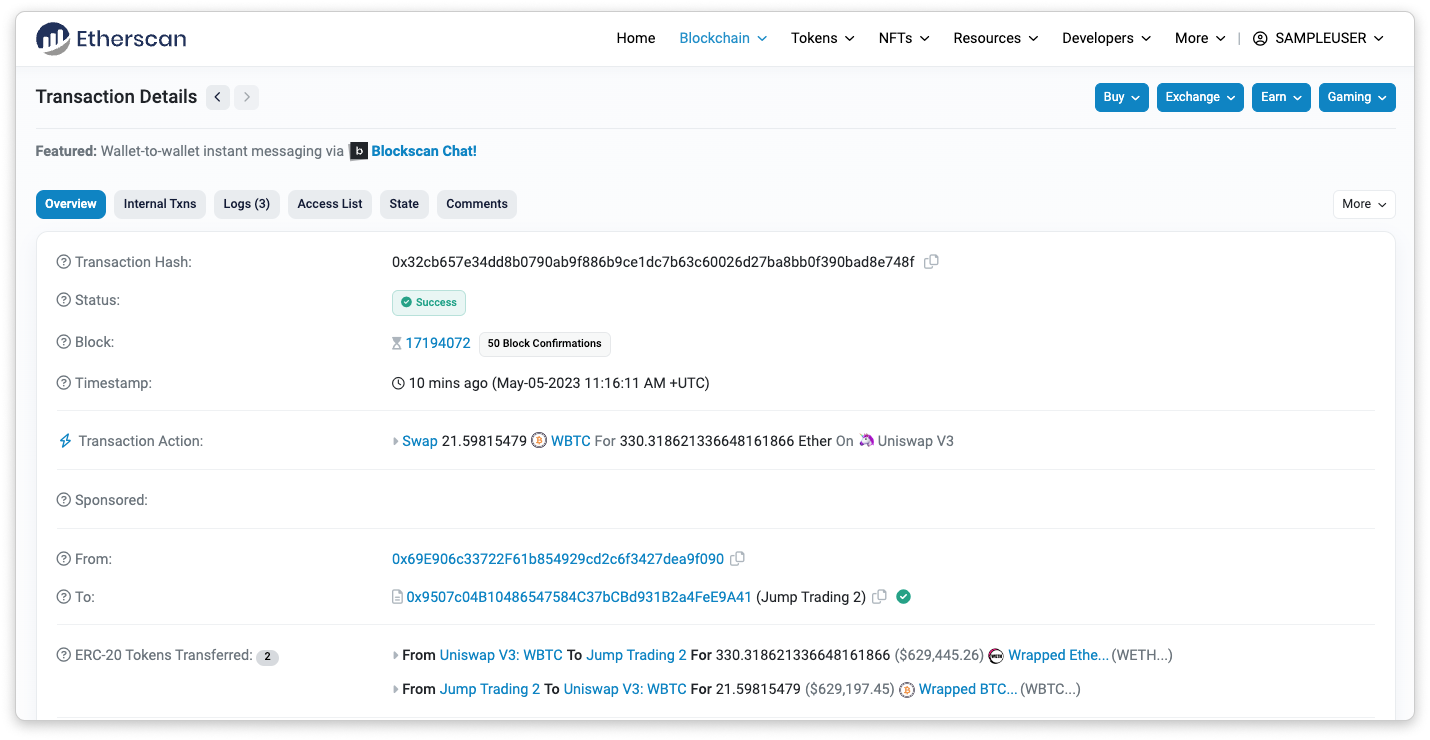

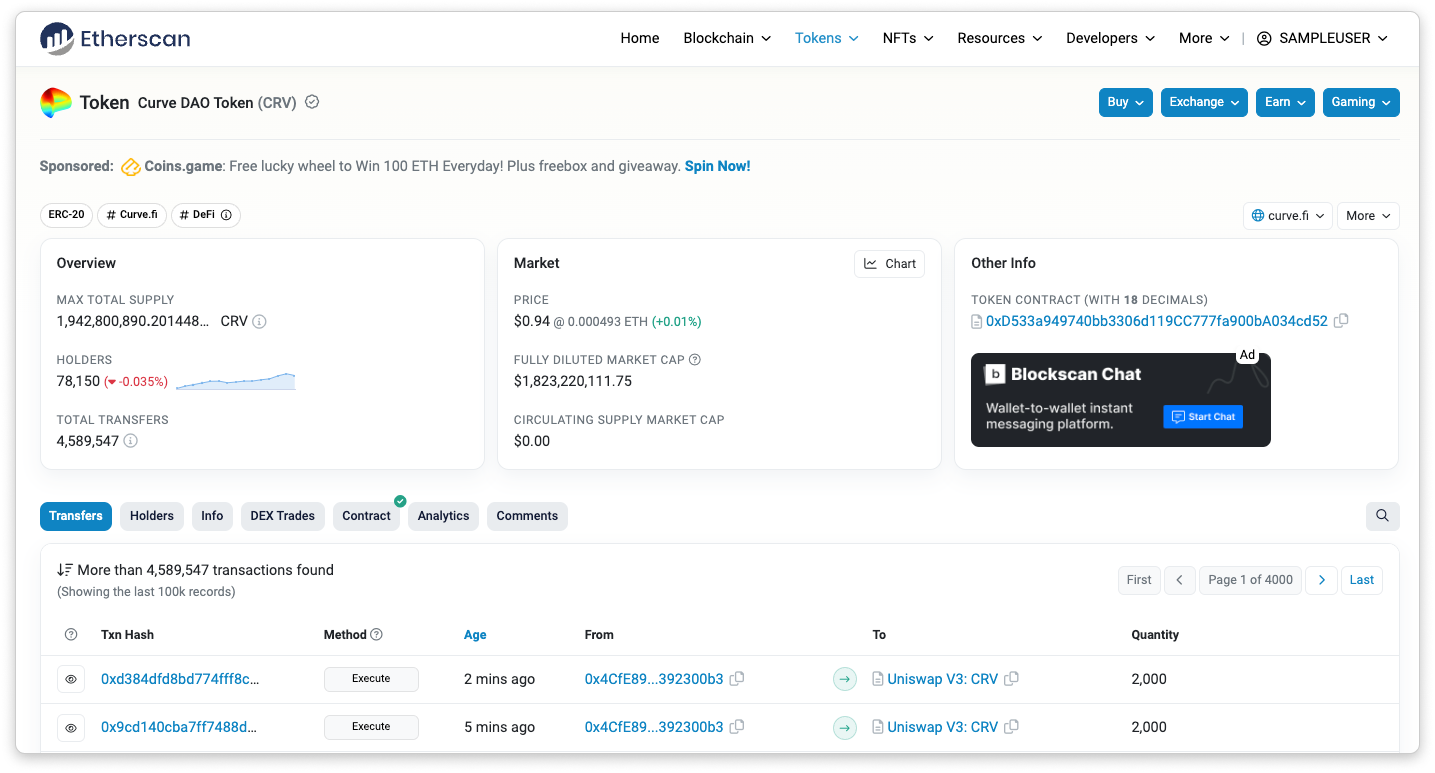

8) Exchange

The decentralized exchange (DEX) allows users to exchange or swap cryptocurrencies while maintaining ownership of their own crypto assets. Although, some technical skills and understanding are required for the process to go through properly.

While, centralized exchanges exist to accommodate users in DeFi activities. Examples include Binance and Coinbase. As a centralized exchange, the platform will act as an intermediary and they will have full access to the funds that you deposited with the exchange.

9) Derivatives

Crypto derivatives are similar to traditional derivatives where an agreement is reached between a buyer and a seller to purchase an underlying asset. There are 3 types of crypto derivatives: Futures, Options and Perpetual Contracts. These derivatives are similar with only a few differences.

Futures is a contract made between buyer and seller to purchase assets with a specified amount and date. Meanwhile, Options are similar to Futures but the buyer may opt to not buy the asset in the future. As for Perpetual Contracts, they do not have expiry date unlike Futures and Options

10) Trading and investment

Most people who get involved in Web3 are doing so mainly for trading and investment. Crypto trading is similar to stock trading. A major difference is that in crypto, you are in control of your assets without any need for a broker. Plus, you are able to access the global market at any time since the market never closes.

11) Lottery

Lotteries are one of the interesting products created in DeFi. PoolTogether is an example that allows you to deposit your cryptocurrency and have a chance of winning its prize pool without any human involvement. It is called a "no-loss lottery" because the pooled amount is invested, and only the interest earned is given to the lottery winner. Others receive back their full deposited amount.

12) Governance

Many DeFi projects are Decentralized Autonomous Organizations (DAO) that allow for governance by its community. DAO token holders are not merely users of a product, but may actively participate in governing it, by way of making and voting on proposals.

13) Insurance

Insurance is a risk management system that allows you to have financial protection in the event of unfortunate events. This DeFi aspect is similar to TradFi, but there are some projects that offer users the opportunity to share the risk together, like Nexus Mutual. Through Nexus Mutual DAO, the members will pool their funds to pay out claims depending on the agreement made.