Explanation on DeFi Liquidation

In DeFi, it refers to the process of selling assets or cryptocurrency from an under-collateralized loan to other stablecoins or fiat. This process can be forced or voluntary depending on the loan conditions. Usually, the events occur when the company or project is insolvent to pay the lenders.

Forced liquidation happens automatically when the investor fails to maintain the requirements set for their leveraged position. Depending on platforms, some of the exchanges incur additional fees for liquidation to encourage users to voluntarily close their positions before being automatically liquidated. Generally, the higher the leverage, the easier the assets get liquidated.

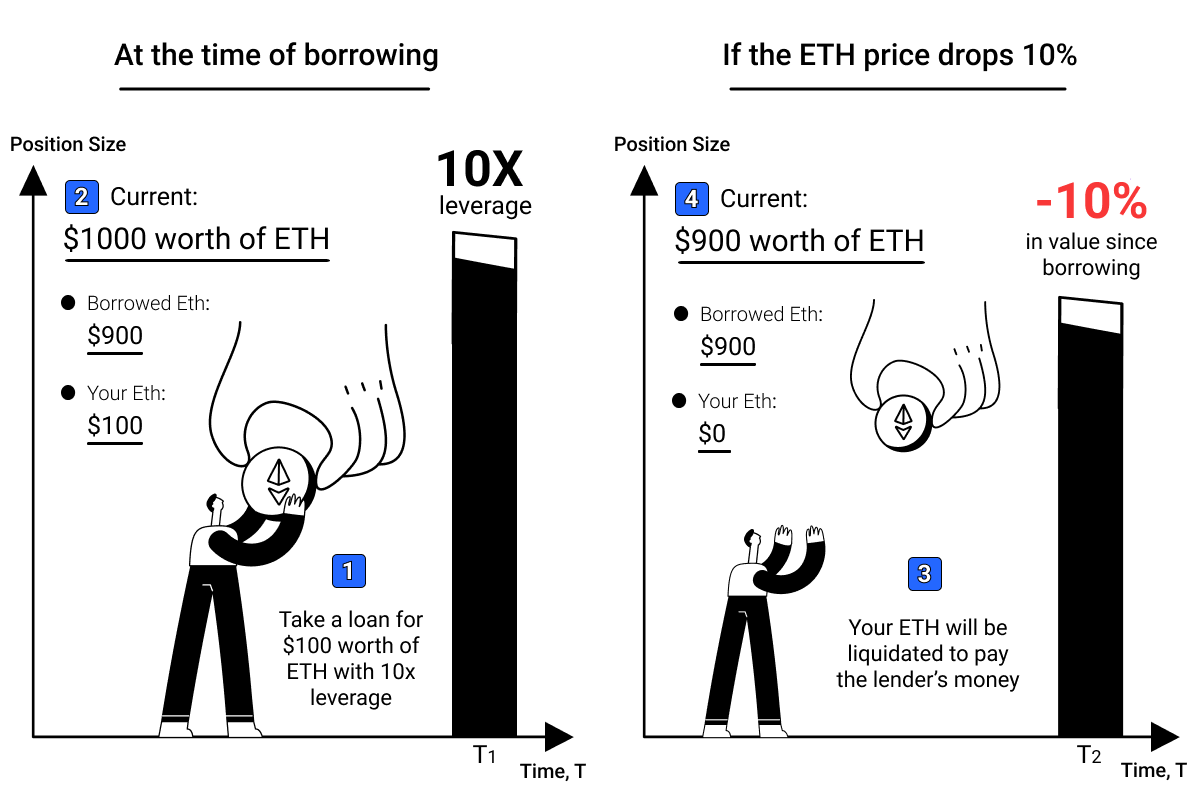

If you take a loan for $100 worth of Eth with 10x leverage, you are in a position size of $1,000 worth of Eth at the current time. Which means, you borrowed $900 worth of Eth along with the initial $100 of Eth you had earlier. If the Eth price drops 10%, the $1,000 Eth worth at the time of borrowing is now $900,and if more losses are incurred, the borrowed fund would be affected. Obviously, the lenders would not want to risk their funds on your behalf, so your fund will be liquidated to keep the lenders money safe.

Example of Defi Liquidation

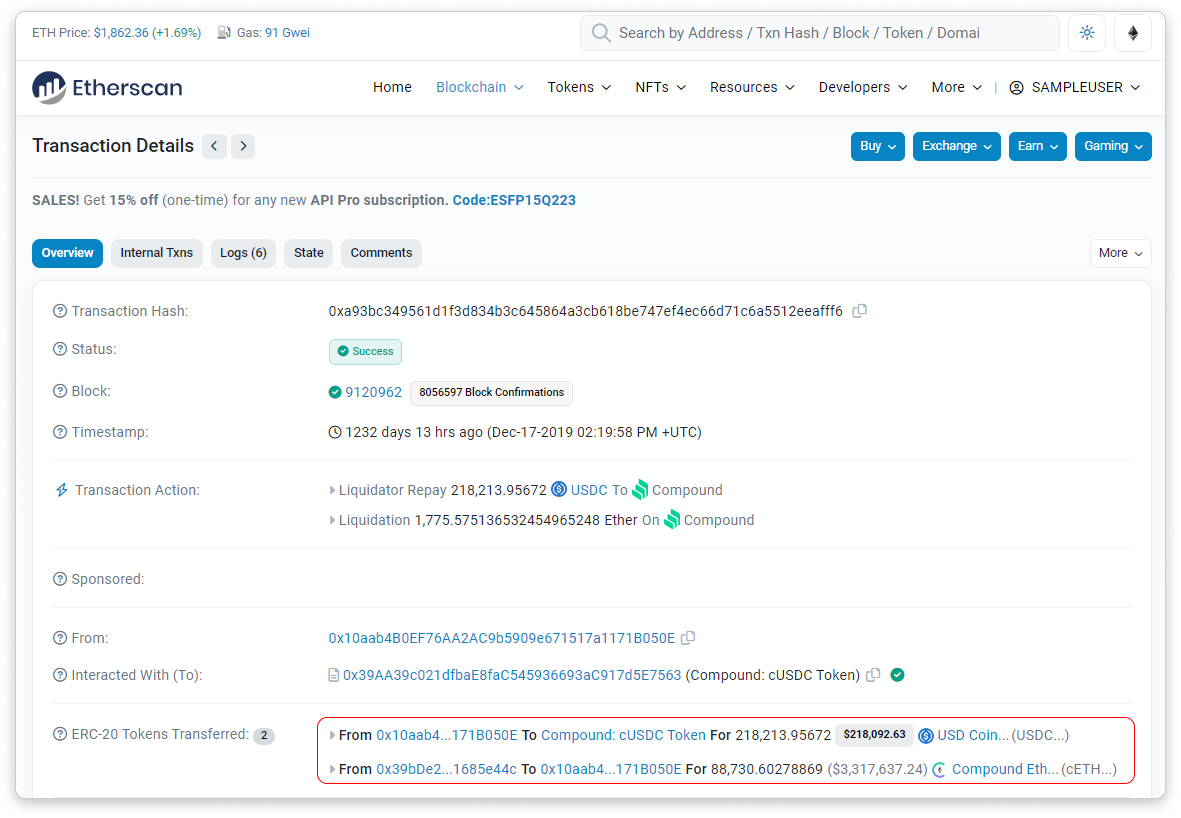

After taking a long position on ETH, a user was unable to maintain their position when the price of ETH suddenly dropped, which caused the user's position to become liquidatable. The resulting liquidation process was carried out by a liquidator who repaid 218k USDC on behalf of the user, and in return, the liquidator received 88k cETH worth of collateral as a reward.

Learn more about DeFi Liquidations here.